Potential Benefits of Direct Indexing

Direct indexing seeks to closely track the performance of a market index while creating tax savings to increase returns in taxable accounts. The potential tax savings can offset capital gains anywhere in a taxable portfolio. Portfolios can be customized to reflect investors’ goals and values in taxable and non-taxable accounts. Investors own individual securities in a direct indexing portfolio via a separately managed account (“SMA”). Holding individual securities rather than a single fund is what allows investors to customize their exposure while providing greater tax efficiency. The direct index SMA can be funded with an existing portfolio of securities, including appreciated stock.

Custom Index Tracking

Portfolio Optimization

Intra-Day Tax Management

Customization

Tax-Advantaged Investing

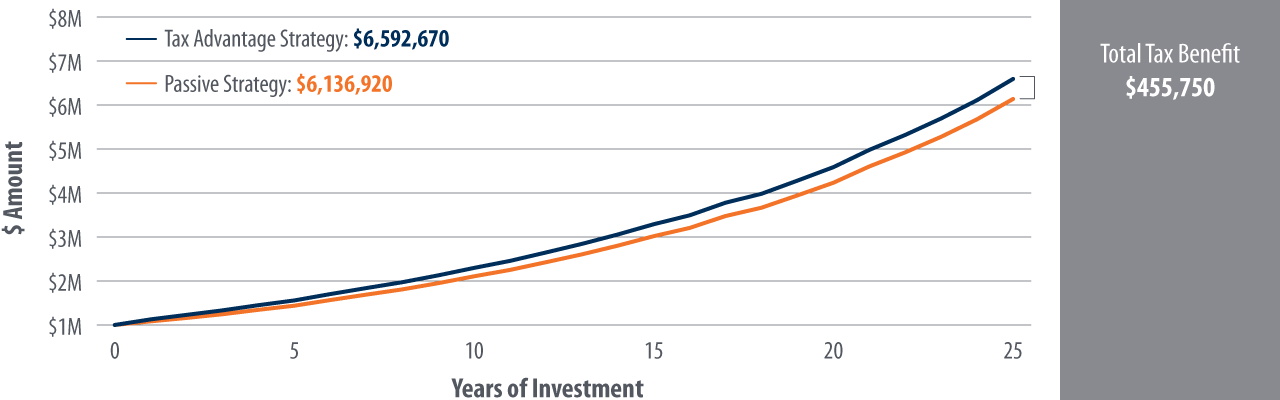

Enhanced After-Tax Returns

Direct indexing provides an enhanced ability to generate tax alpha, which optimizes after-tax returns. While alpha is a measure used to evaluate portfolio returns in excess of a benchmark index, tax alpha is a measure of after-tax account return that exceeds pre-tax return in excess of a benchmark. The example shown here illustrates the tax alpha that may be achieved by the growth of an initial investment over a 25-year period.

Tax-Efficient Transitions of Appreciated Securities

Proper tax management is especially important when exiting securities with appreciated gains. When transitioning securities into a Direct Index SMA, the account can be funded in-kind without creating a taxable event. The tax management tools available through direct indexing can be used to achieve a tax-efficient portfolio transition and potentially minimize, delay, or avoid net taxes.

Assumptions: Initial Investment Amount: $1 Million | Annualized Equity Market Return: 8% | Dividend Tax Rate: 23.80% | Long-Term Capital Gains Tax Rate: 23.80% | Short-Term Capital Gains Tax Rate: 40.80%. This sample provided does not reflect the investment results of actual securities and is not a guarantee of future results. Changes to the assumptions will drastically change the results. Chart Methodology: The sample provided assumes a starting basket of 300 equally-weighted hypothetical securities. Returns are randomly simulated monthly with the annualized mean chosen above and annualized standard deviation of 30%. It is assumed that the portfolio's 2% annualized dividend yield is subject to income tax and is reinvested monthly into a new tax lot. The "Passive" strategy simulates a buy-and-hold strategy over the investment horizon. The "Tax-Advantaged" strategy simulates a tax-loss harvesting strategy. In any period that a tax lot's cumulative loss exceeds 5%, the tax lot is sold, and the proceeds are immediately reinvested, plus any tax benefit, into a new tax lot. Tax benefit calculations assume that the capital gains offset by the harvested loss are 50% short-term and 50% long-term. The Monte Carlo simulation takes an average across 2000 iterations for each set of return, risk, and tax assumptions. The sample presented does not represent actual trading of securities and is not indicative of actual investment strategy performance. The impact of market factors is not included in this simulation which may cause the results to be over-or-under stated. This should not be construed as a representation that any account will, or is likely to, achieve profits, losses or tax savings similar to those reflected in this example.

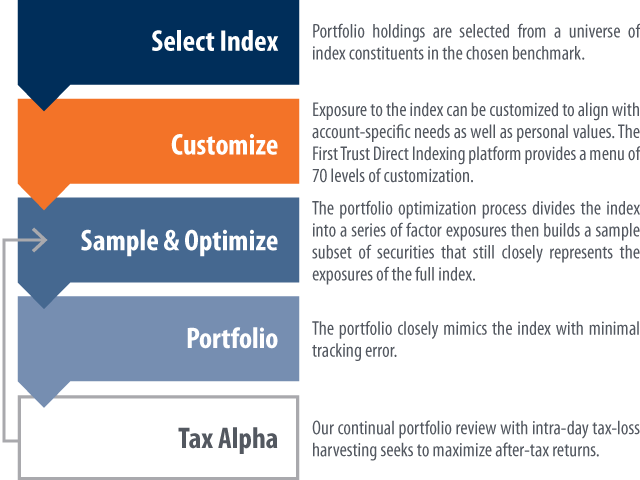

Why Choose First Trust Direct Indexing?

First Trust Direct Indexing provides exposure to a variety of benchmarks through direct ownership of individual securities in a portfolio via a tax-advantaged SMA. These SMAs offer continual portfolio review with intra-day tax-loss harvesting to provide a greater ability to generate tax alpha. They can be customized based on factor tilts or personal values while keeping tracking error in line with a specified target.

- arrow_right Continual portfolio review with intra-day tax-loss harvesting

- arrow_right Select from integrated major branded indexes

- arrow_right Index blending and custom benchmark development

- arrow_right Portfolio customization with over 70 preset options

- arrow_right Capital gains budgeting

-

arrow_right

Access to intuitive advisor user interface

Access to intuitive advisor user interface

- arrow_right On-demand quarterly performance reports

- arrow_right Real-time portfolio transition analysis and reporting

- arrow_right Implementation specialists to support client onboarding

- arrow_right Solutions for Institutional and tax-exempt organizations

- arrow_right Fund with cash or in-kind securities

Institutional Capabilities

We bring a wealth of institutional investment experience, a consultative approach, and a strong commitment to crafting thoughtful solutions tailored to your unique needs.

- arrow_right Bespoke investment solutions

- arrow_right Consultative approach

- arrow_right Quantitatively driven

- arrow_right Qualitative analysis

- arrow_right Mission-aligned portfolios

- arrow_right Expertise in faith-based investing

- arrow_right Factor tilts

- arrow_right Risk management

- arrow_right Low tracking error post-screening

- arrow_right Proxy voting services (standard & custom)

- arrow_right Insightful performance reporting

Customization

Investors can express their view through traditional factors, risk management strategies, or values-based investing. Our platform offers a vast amount of preset options to add or eliminate companies, industries and sectors. We also offer the ability to blend indexes and build custom solutions.

- arrow_right Qualitative Screens

- arrow_right Quantitative Factors

- arrow_right Broad Governance Preferences