Custom Option Solutions

Our innovative option overlay solutions allow for easy implementation to both retail and institutional portfolios. Each case is fully customized and tailored to the investor’s goals and objectives. Every account is unique to that investor and managed according to the policies established.

Hedged Strategies

- arrow_right Protective Puts

- arrow_right Stock Collars

Income Enhancement

- arrow_right Covered Call Income

Diversification Strategies

- arrow_right Covered Call Transition Direct Indexing

- arrow_right Hedged Equity Exchange

Potential Benefits of Option Overlay

Option overlay strategies seek to mitigate risk and may help achieve a client’s goals in several ways:

- arrow_right Preserve Capital

- arrow_right Generate Income

- arrow_right Offset Capital Gains Tax

- arrow_right Generate Liquidity

- arrow_right Diversify Exposure

- arrow_right Increase Borrowing Capacity

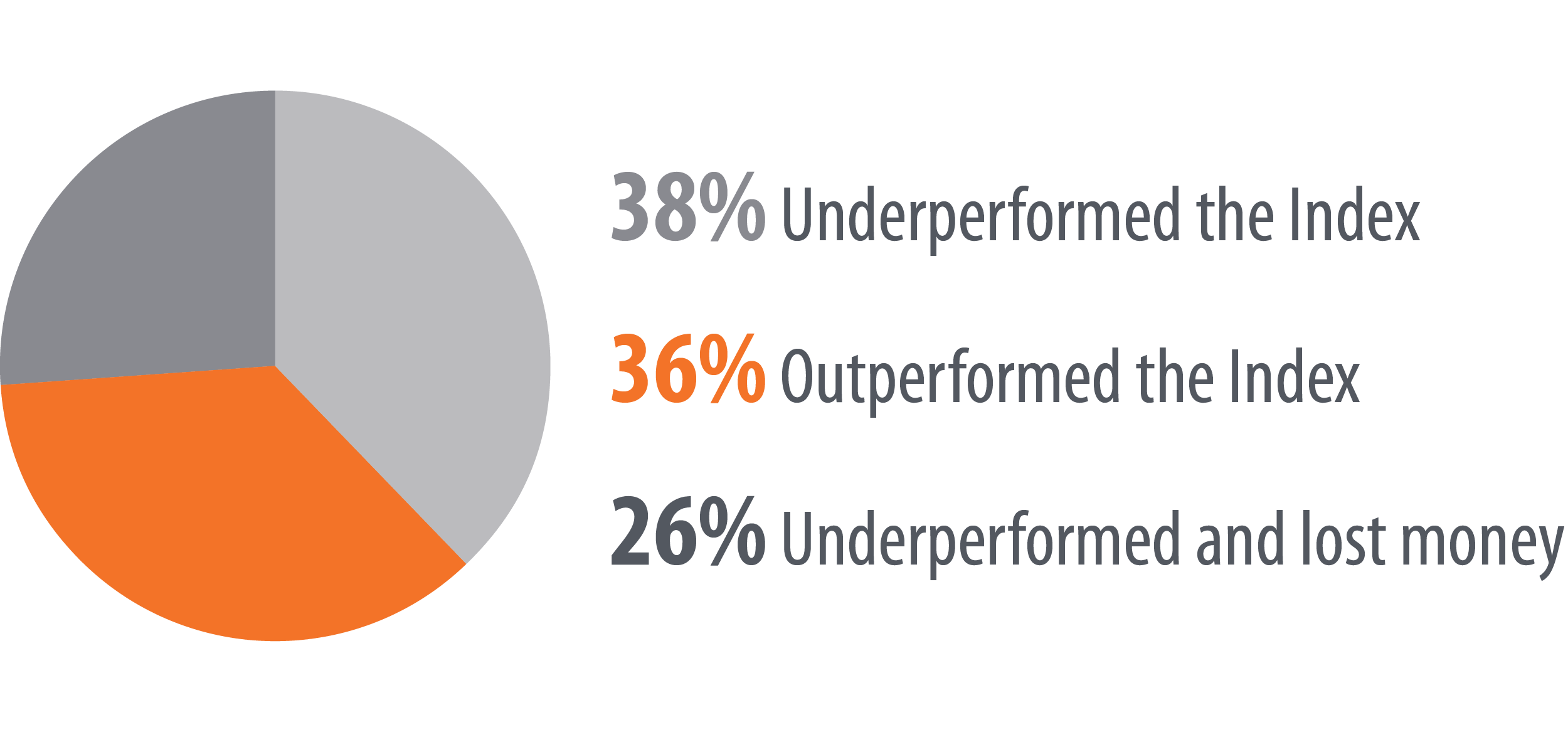

Historical Return Breakdown of the S&P 500® Index Constituents

Since 1990, approximately 35% (or about a third) of the stocks in the S&P 500® Index went down by at least 50% and remain below that level.

65% of the S&P 500® Index constituents underperformed the Index.

For stocks in the S&P 500® Index since 1990, the average volatility has measured 29.81% compared to 18.08% for the index itself.

Past performance is not a guarantee of future results.

Data from 1/31/1990 to 12/31/2024. Sources: Capital IQ and Bloomberg. Returns are measured from the date added to the index (or start of the study period) to the date removed (or end of the study period) for all companies included in the index during the study period, using month-end prices. Index data shown is for illustrative purposes only and not indicative of any actual investment. Indexes do not charge management fees or brokerage expenses and no such fees or expenses were deducted from the performance shown. Indexes are unmanaged and investor cannot invest directly in an index.

IMPORTANT: THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN INVITATION, OFFER, SOLICITATION OR RECOMMENDATION TO ENGAGE IN ANY OPTIONS TRADING STRATEGY. An investment decision should not be made based solely on the information presented herein. There is no guarantee any options sold will not be exercised prior to the portfolio managers’ attempt to close out a short options position. This will cause an investor to sell shares of their existing stock position at the option strike price in the case of a call option, or purchase shares at the strike price in the case of a put option and will limit an investor’s ability to participate in potential gains or avoid losses beyond the strike price. This should not be construed as a representation that any portfolio will, or is likely to, achieve a specific level of profits, losses or tax savings. Results may vary over time. Accordingly, the information provided should not be considered indicative of the portfolio managers’ competence or skill.

Key Options Risks:

Options trading is not appropriate for all investors.

Writing and buying options are speculative activities and entail investment exposures that are greater than their cost would suggest, meaning that a small investment in an option could have a substantial impact on performance. The use of call and put options can lead to losses because of adverse movements in the price or value of the underlying stock, index, or other asset, which may be magnified by certain features of the options. These risks are heightened when options are used to enhance a client’s return or as a substitute for a position or security. When selling a call or put option, a client will receive a premium; however, this premium may not be enough to offset a loss incurred by the client if the price of the underlying asset is above or below, the strike price, respectively, by an amount equal to or greater than the premium. The value of an option may be adversely affected if the market for the option becomes less liquid or smaller and will be affected by changes in the value or yield of the option’s underlying asset, an increase in interest rates, a change in the actual or perceived volatility of the stock market or the underlying asset and the remaining time to expiration.

Writing a call or put option can lead to an assignment upon an exercise of a call or put option. In the case of a short call, an assignment can lead to a forced sale of the underlying security being held as collateral. Being short a put can lead to a forced purchase of the underlying security for which additional capital may have to be contributed by the account holder (i.e., “margin call”). Such involuntary sale and purchase transaction may occur at inopportune market times, which could result in losses to an account.

In the case of an option purchase (long call or long put), a client’s entire initial investment of premium can be lost. In the case of a covered option short sale (short call or short put), upside gains can be limited by the sale of a short call against an underlying stock position and a forced purchase of stock can occur in the case of a short cash covered put sale. In the case of a naked call or put sale (a call with no underlying stock position and a put with no cash to cover the possibility of a forced stock purchase) there is the risk of unlimited loss in the call position and substantial loss in the put position.

Options trading is not appropriate for all investors. There can be no assurance that a strategy will achieve its investment objectives.

Please refer to Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD), which discusses potential risks of options issued by the Options Clearing Corporation (OCC), which are typically listed on an exchange. Visit https://www.theocc.com/Company-Information/Documents-and-Archives/Options-Disclosure-Document.

The custom option strategies were previously managed by First Trust Investment Solutions (FTIS). Effective October 31, 2024, FTIS merged into First Trust Advisors L.P. (“FTA”). All business activities, including portfolio management and business records are now performed under FTA.

Kevin Erndl is the portfolio manager for the first Trust Advisors L.P. custom options investment strategies. Mr. Erndl is also registered with an unaffiliated investment advisor, CWA Asset Management Group, LLC (“CWA”). Mr. Erndl is allowed to remain an investment adviser representative with CWA in order to service his current CWA client accounts (“CWA clients”) during a transition period of up to 20 months beginning August 31, 2023 (“transition period”). Mr. Erndl receives compensation from CWA in exchange for providing his CWA clients advisory services through CWA during the transition period. Mr. Erndl will not seek any new CWA clients. In addition, during this transition period, Mr. Erndl’s activities, as they relate to his CWA clients, will be limited to providing financial planning and guidance on asset allocation. He will not make any investment decisions on behalf of his CWA clients. The assets of Mr. Erndl’s CWA clients invested in a custom options investment strategy managed by Mr. Erndl will be deducted from strategy assets under management when calculating advisory fees so that CWA clients will not be charged twice for advisory services.